Understanding Payment Card Processing: Tokenization: How Payment Data is Secured During Transactions

In today's digital economy, the security of payment card data has become paramount. As cyber threats evolve and digital transactions increase, the payment industry has developed sophisticated methods to protect sensitive card information. Among these innovations, tokenization stands as a cornerstone of modern payment security, fundamentally changing how we protect cardholder data during transactions.

What is Payment Tokenization?

At its core, tokenization is the process of replacing sensitive card data with a unique identifier, called a token. This token maintains the essential format of the original data while having no intrinsic value to potential attackers. When your card interacts with a payment gateway or e-commerce platform, tokenization converts your card number into this secure token, ensuring your actual card details never reside in merchant systems.

The Role of Payment Gateways in Tokenization

Payment gateways serve as the critical first point of interaction for payment data in digital transactions. These specialized platforms not only facilitate the secure transmission of payment information but also integrate tokenization services directly into their infrastructure. When a customer enters their card details through a payment gateway, the tokenization process begins immediately, ensuring that sensitive data is protected from the very first moment of capture.

Modern payment gateways offer sophisticated tokenization solutions that work across multiple channels, from e-commerce websites to mobile applications. They maintain secure connections with token vaults and can manage token lifecycle operations, including creation, storage, and retrieval when needed for recurring transactions.

The Technical Foundation of Tokenization

The system generates a token that serves as a secure reference for the transaction, while Format Preserving Encryption ensures that this token maintains a usable structure without exposing actual card details.

How Tokenization Works in Practice

When you initiate an online payment, your card data is captured and immediately tokenized before it enters the merchant's environment. This token then travels through the payment ecosystem, passing between the merchant, acquiring bank, payment networks, and issuing bank. Each entity in this chain can process the transaction using the token without ever handling the actual card number.

The Role of Token Vaults

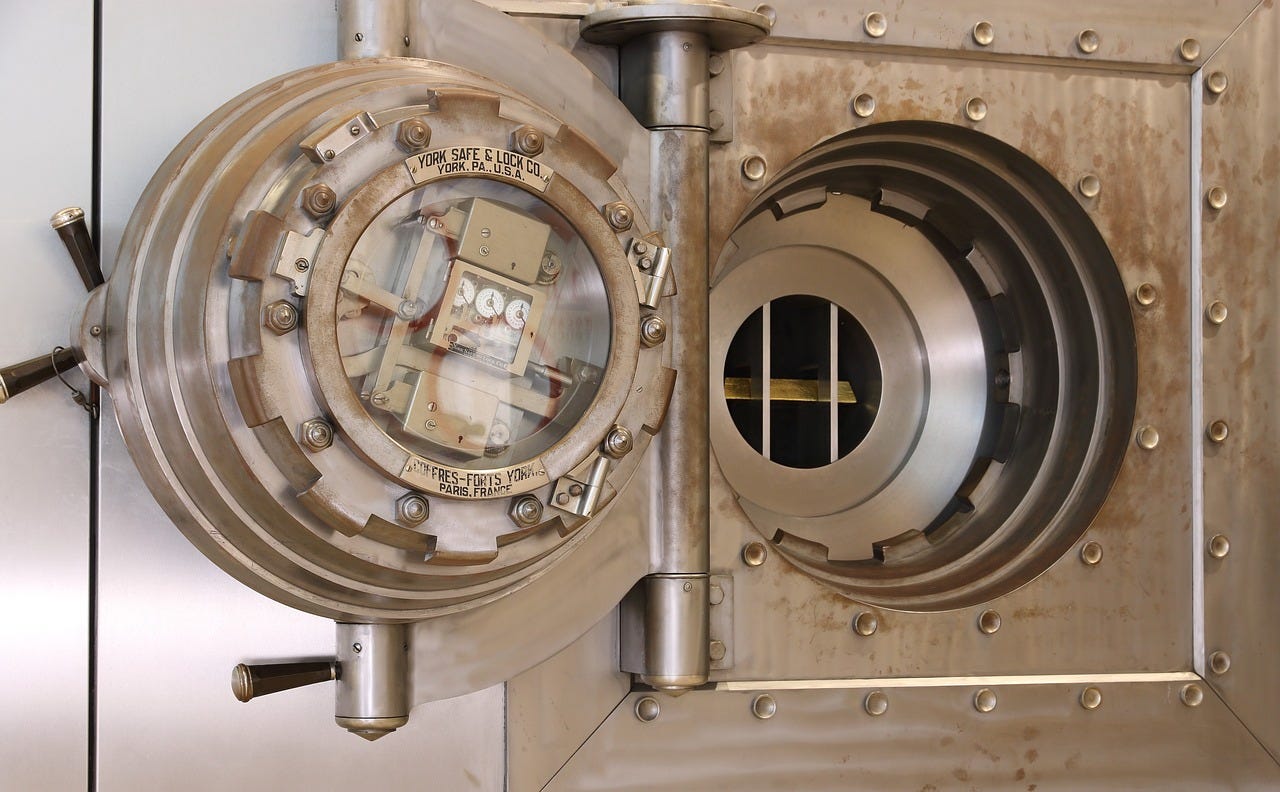

Behind the scenes, token vaults play a crucial role in the tokenization process. These highly secure databases maintain the relationship between tokens and their corresponding card numbers. Only authorized entities with proper credentials can access the vault to retrieve original card data when absolutely necessary, such as during final settlement processes.

Security Benefits of Tokenization

Tokenization provides multiple layers of security benefits. First, it significantly reduces the scope of PCI DSS compliance for merchants by removing actual card data from their systems. Second, even if a token is compromised, it cannot be used to create fraudulent transactions since it's meaningless outside the specific payment ecosystem. Third, tokens can be limited to specific merchants, payment channels, or transaction types, adding another layer of security.

Integration with Modern Payment Systems

Modern payment processing systems have deeply integrated tokenization into their architecture. Payment gateways and Payment Service Providers (PSPs) offer tokenization as a standard feature, making it easier for merchants to implement this security measure. The technology works seamlessly with various payment methods, from traditional card-present transactions to digital wallets and recurring payments.

Real-time Security Verification

Within milliseconds of token generation, multiple sophisticated security systems spring into action. Advanced fraud detection algorithms analyze the transaction pattern, while velocity checks ensure the activity aligns with normal usage patterns. These processes happen simultaneously with tokenization, contributing to the system's remarkable efficiency without compromising security.

The Evolution of Tokenization Technology

Tokenization continues to evolve with technological advancement. Network tokens are becoming increasingly prevalent, offering enhanced security for digital commerce. Mobile payment solutions leverage tokenization for secure card-on-file transactions, while advanced cryptographic techniques are exploring new possibilities for token management and security.

Impact on Payment Innovation

The security provided by tokenization has enabled significant innovation in payment services. Digital wallets, contactless payments, and in-app purchasing have all benefited from the protection tokenization offers. This security framework has become essential for new payment technologies, ensuring that convenience doesn't come at the cost of security.

Implementation Considerations

For businesses implementing tokenization, several factors require consideration. The choice of tokenization provider, integration methods, and token storage solutions all play crucial roles in the overall security strategy. Organizations must also consider how tokenization fits into their broader payment security framework, including encryption, fraud prevention, and compliance requirements.

Future Directions in Payment Security

As we look to the future, tokenization will continue to evolve. The integration of artificial intelligence for token management, the expansion of network tokenization, and the development of new token formats for emerging payment methods are all on the horizon. These advancements will further enhance the security and efficiency of payment processing while enabling new payment innovations.

Conclusion

Tokenization represents a crucial advancement in payment security, providing robust protection for sensitive card data while enabling payment innovation. As digital transactions continue to grow, the role of tokenization in securing payment data becomes increasingly vital. Are you curious about how implementing advanced tokenization solutions could enhance your payment security while reducing compliance burden?

Enjoyed this article?

We regularly publish insights on payment strategy, risk, and governance.

You will find more articles here

Let’s talk if you think Payment Matters could be the right fit for your needs.

Reach out to discuss how we can support your organisation

paymentmatters.com.au